No Matter Where You Live! Your Taxes Done With Ease. The W-form is also used for other purposes and this can make the instructions confusing. W-forms are also used for interest income, dividend income, and barter transactions as well.

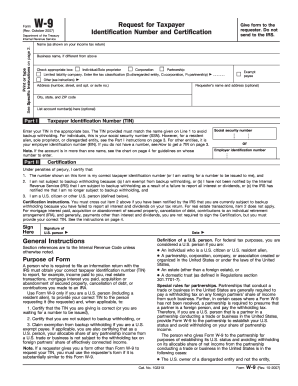

What is the W9: step-by-step instructions. Full name of W-is “Taxpayer Identification Number and Certification” considered to be one of the top requested IRS forms that are printed. The Form W-instructions list the exempt payees and their codes and the types of payments for which these codes should be used. Corporations filling out a W-for receipt of interest or dividend. Wage and Tax Statement.

Instructions for Form W-(PDF) Form W-2. Employers must file a Form W-for each employee from whom Income, social security, or Medicare tax was withheld. How to make a fillable PDF?

W-is an official document, which was developed to deliver essential information to the requester. It’s then used to complete other forms, which will be sent to IRS. If the bureau finds out something is wrong with the information you’ve provide you might become a subject to penalties. There are lots of questions on the topic that has to. Form W-is used by a third-party taxpayer to present information return with the IRS.

The personal information and address of the taxpayer must be filled on the Form W-9. Because of the lots of paperwork and a time-taking process, taxpayers don’t really want to make any mistakes while filling out Form W-9. Our article includes every step. Create your documents via computers and mobiles and forget about any software installing! W-9s are ONLY required for Loan-out corporations, not for un-incorporated employees.

W-9s must be accompanied by the articles of incorporation. A loan-out is a single-member “S” or “C” corporation, ABS does not pay Sole Proprieto. Complete forms electronically utilizing PDF or Word format. Make them reusable by making templates, add and fill out fillable fields. Department creates a new vendor request.

The Vendor Desk will send a request to the vendor, with instructions on how to upload the W-9. The IRS requires businesses and organizations to obtain Form W-from certain non-corporate payees for purposes of filing these information returns. The business then reports the information obtained from Form W-to the IRS, along with the tax information about payments the business or organization made to the payee during the year.

IRS W-form step-by-step instructions. Now let’s take a closer look on the blank itself so that you know how to complete the document correctly. The first step is to get it.

Though, in most cases you’ll get the blank from the requester.

Žádné komentáře:

Okomentovat

Poznámka: Komentáře mohou přidávat pouze členové tohoto blogu.